Introduction

Investing in the stock market can seem daunting for new investors, but with the right strategies, it can be a rewarding journey. This article will provide ten essential stock market investment strategies to help you navigate the financial markets with confidence and build a solid foundation for long-term wealth. By understanding key concepts, setting clear goals, and adopting a disciplined approach, you can mitigate risks and maximize returns. Whether you are saving for retirement, a major purchase, or simply looking to grow your wealth, these strategies will equip you with the knowledge and tools needed to succeed in the stock market.

Understand the Basics of the Stock Market

Before diving into stock market investments, it’s crucial to understand how the market works. Stocks represent ownership in a company, and their prices fluctuate based on supply and demand, company performance, and broader economic factors. Familiarize yourself with key concepts such as market capitalization, stock exchanges, and stock indices to build a strong knowledge base. Additionally, understanding the roles of dividends, earnings reports, and market trends can provide deeper insights into stock movements. By grasping these fundamentals, you can make more informed investment decisions and better navigate the complexities of the stock market.

Set Clear Financial Goals

Setting clear financial goals is the first step toward a successful investment journey. Determine what you aim to achieve with your investments. Are you saving for retirement, a down payment on a house, or your children’s education? Having specific goals will guide your investment decisions and help you stay focused. Moreover, consider your risk tolerance, time horizon, and liquidity needs when setting these goals. A well-defined plan tailored to your unique circumstances will increase the likelihood of achieving financial success in the long run.

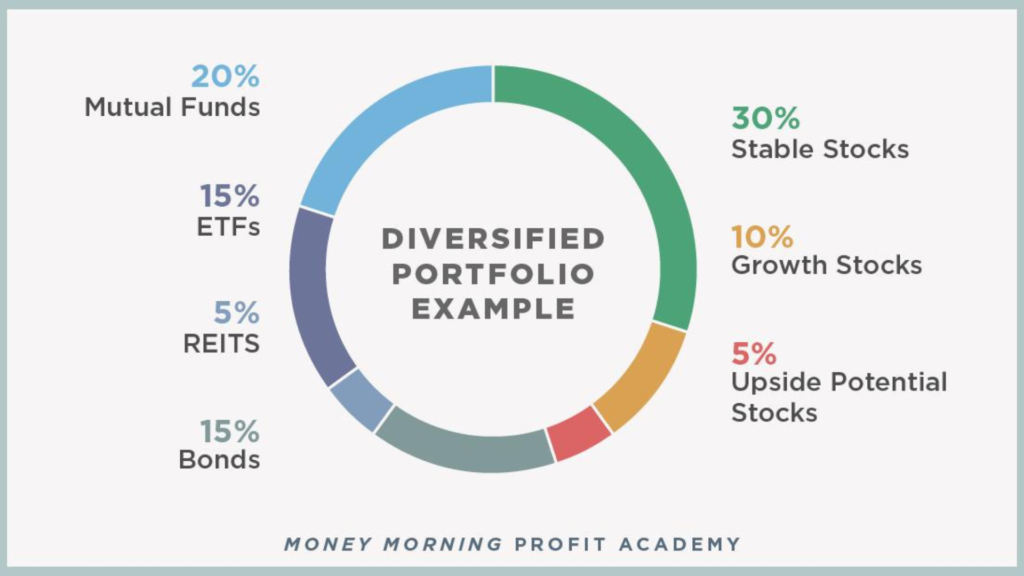

Start with a Diversified Portfolio

Diversification is a fundamental principle of investing that helps reduce risk. By spreading your investments across different asset classes, sectors, and geographic regions, you can mitigate the impact of a poor-performing investment on your overall portfolio. Consider including a mix of stocks, bonds, and other investment vehicles to achieve a balanced portfolio. diversification can also include alternative assets like real estate, commodities, or even cryptocurrencies, depending on your risk tolerance and investment objectives. This approach ensures that your portfolio is not overly reliant on any single asset or market segment, enhancing stability and potential returns over time.

Invest in Index Funds or ETFs

For new investors, index funds and exchange-traded funds (ETFs) are excellent options. These stock market funds track a specific index, such as the S&P 500, and provide broad market exposure at a low cost. Investing in index funds or ETFs allows you to benefit from the overall growth of the stock market without the need to pick individual stocks. Moreover, these funds offer diversification within a single investment, reducing the risk associated with individual stock selection. They are also known for their transparency, liquidity, and tax efficiency, making them attractive choices for both novice and experienced investors alike.

Focus on Long-Term Growth

Stock market investing is best suited for long-term goals. Attempting to time the market or chase short-term gains can be risky and often leads to losses. Instead, adopt a long-term perspective and stay committed to your investment strategy. Historical data shows that the stock market tends to rise over the long term, despite short-term volatility. Furthermore, focus on fundamental analysis and the underlying value of your investments rather than reacting to daily market fluctuations. Diversifying your portfolio, maintaining a balanced asset allocation, and staying patient during market downturns are key strategies for long-term investment success.

Research and Analyze Stocks Thoroughly

When investing in individual stocks stock markets, thorough research is essential. Evaluate a company’s financial health, management team, competitive position, and growth potential. Use financial metrics such as price-to-earnings (P/E) ratio, earnings per share (EPS), and return on equity (ROE) to assess a company’s valuation and performance. Make informed decisions based on your analysis. Additionally, consider qualitative factors such as industry trends, regulatory environment, and the company’s strategic vision. Conducting comprehensive research and staying updated with company developments will enhance your ability to identify promising investment opportunities and make sound investment decisions.

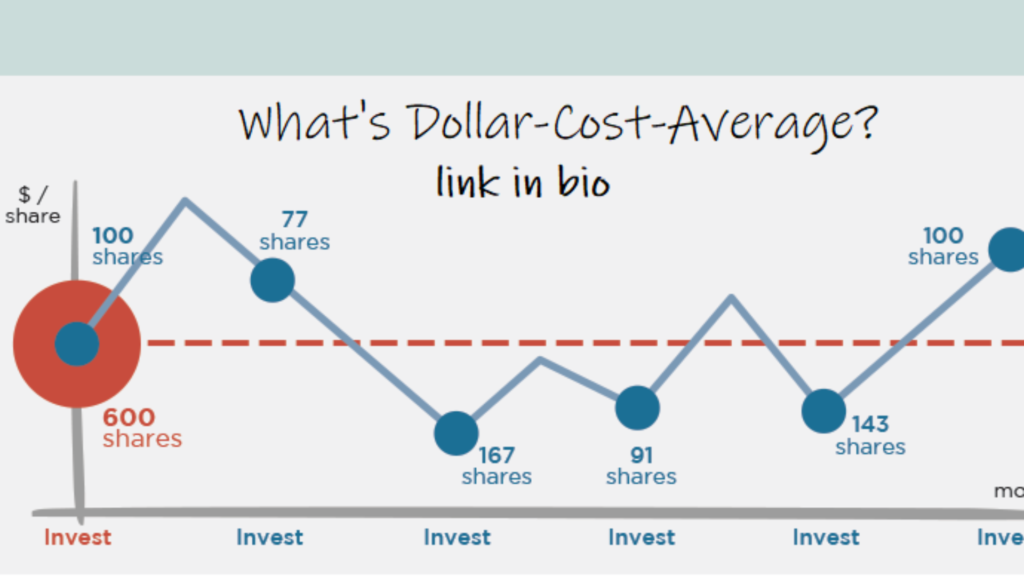

Practice Dollar-Cost Averaging

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market conditions. This strategy reduces the impact of market volatility by spreading your purchases over time. It also helps you avoid the temptation to time the market and encourages disciplined investing. Moreover, dollar-cost averaging takes advantage of market fluctuations, allowing you to buy more shares when prices are low and fewer shares when prices are high. This approach can lead to a lower average cost per share over time and potentially higher returns in the long run.

Reinvest Dividends for Compounding Returns

Dividends are a portion of a company’s profits distributed to shareholders. Reinvesting dividends allows you to purchase more shares, which can lead to compounding returns over time. Many brokerage accounts offer automatic dividend reinvestment plans (DRIPs) to simplify this process. Compounding can significantly enhance your portfolio’s growth. Additionally, dividend-paying stock markets can provide a steady stream of income, making them attractive for investors seeking passive income alongside potential capital appreciation. Reinvesting dividends can accelerate wealth accumulation and contribute to long-term financial success.

Stay Informed About Market Trends and News

Staying informed about market trends and news is crucial for making informed investment decisions. Follow financial news, subscribe to investment newsletters, and read market analysis reports. Understanding economic indicators, corporate earnings reports, and geopolitical events can help you anticipate market movements and adjust your strategy accordingly. Additionally, staying connected with industry experts, attending investment seminars or webinars, and participating in online forums or communities can provide valuable insights and perspectives. Continuous learning and staying updated with the latest market developments empower investors to make proactive and strategic investment choices, enhancing their overall investment success.

Avoid Emotional Investing

Emotional investing can lead to poor decision-making and significant losses. Fear and greed are common emotions that can cause investors to buy high and sell low. Develop a disciplined investment approach and stick to your plan, even during market downturns. Having a well-defined strategy can help you stay focused and make rational decisions. Moreover, practice mindfulness and self-awareness to recognize emotional triggers and avoid impulsive actions. Implementing risk management techniques, such as setting stop-loss orders or diversifying investments, can also mitigate emotional biases and enhance portfolio resilience. By maintaining discipline and staying rational, investors can navigate market fluctuations more effectively and achieve long-term financial goals.

Regularly Review and Adjust Your Portfolio

Regularly reviewing your portfolio is essential to ensure it remains aligned with your financial goals. Assess your asset allocation, rebalance your portfolio if necessary, and evaluate the performance of your investments. Life events, market conditions, and changes in your financial goals may require adjustments to your investment strategy. Additionally, consider the impact of economic cycles, interest rate changes, and geopolitical events on your portfolio. Reassessing your risk tolerance and investment time horizon periodically can also help in making informed adjustments. Stay proactive in monitoring your investments and be prepared to reallocate assets or explore new opportunities as needed to stay on track toward achieving your financial objectives.

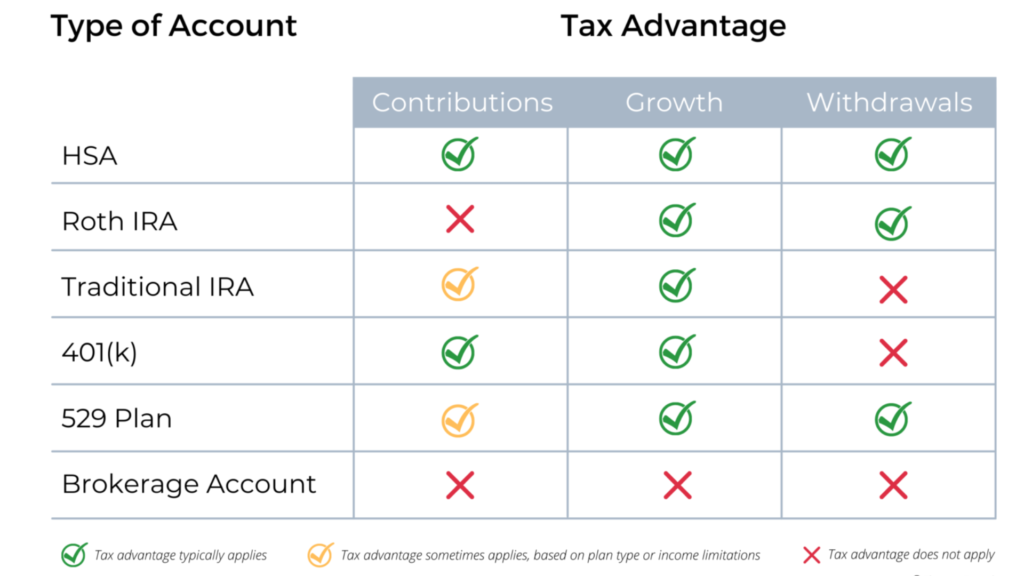

Utilize Tax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k)s, IRAs, and Roth IRAs, offer significant tax benefits that can enhance your investment returns. Contributions to these accounts may be tax-deductible, and the investments grow tax-deferred or tax-free. Maximize your contributions to these accounts to take full advantage of the tax benefits. Additionally, explore employer matching contributions for 401(k)s and consider catch-up contributions for IRAs if you’re age 50 or older. Understand the contribution limits, withdrawal rules, and potential penalties associated with each account type to optimize your tax savings and retirement readiness. Regularly review your retirement savings strategy and consult a tax advisor for personalized guidance on tax-efficient investment planning.

Seek Professional Advice When Needed

If you’re unsure about your investment decisions or need personalized guidance, consider seeking advice from a financial advisor. A professional can help you develop a tailored investment plan, provide insights based on their expertise, and assist you in navigating complex financial situations. Choose a reputable advisor who acts in your best interest. Additionally, clarify their fee structure, credentials, and fiduciary responsibility to ensure transparency and alignment with your goals. Regularly review your financial plan with your advisor to make adjustments as needed and stay on track toward achieving your financial objectives.

Conclusion

Investing in the stock market can be a powerful way to build wealth, but it requires knowledge, discipline, and a long-term perspective. By understanding the basics of the stock market, setting clear financial goals, and following these ten strategies, new stock market investors can increase their chances of success. Remember, investing is a journey, and continuous learning and adaptation are key to achieving your financial objectives in the stock market.