Bootstrapping Basics Building on Your Own Foundation

Bootstrapping is a classic approach, relying on personal savings, sweat equity, and resourceful innovation. It allows you to retain full control of your business but requires careful budgeting and creative problem-solving. Start by creating a lean business plan outlining your startup costs and potential revenue streams. Explore cost-effective marketing strategies, utilize free online tools, and consider offering pre-sales or pre-orders to generate early cash flow.

Friends & Family A Familiar Face of Support

Leveraging your network can be a great way to secure early-stage funding. Friends and family often believe in your vision and may be willing to invest based on their faith in you. However, clear communication is crucial. Draft a formal agreement outlining the terms of the investment, including repayment expectations and equity stake, if applicable. This protects both your relationships and your business.

Angel Investors Seeking Mentorship and More Than Money

Angel investors are experienced individuals who invest their own money in promising startups. They offer not only capital but also valuable mentorship and guidance. Research potential angel investors who align with your industry and investment style. Craft a compelling pitch deck that highlights your business potential, market opportunity, and growth strategy. Be prepared to answer questions about your financial projections and exit strategy (how investors will recoup their investment).

The Power of Crowdfunding Funding from the Masses

Crowdfunding platforms allow you to raise capital from a large pool of online contributors. This approach can be a great way to validate your concept, build brand awareness, and pre-sell your product or service. Choose a platform that aligns with your target audience and campaign goals. Offer compelling rewards for different contribution levels, and actively engage with your backers throughout the campaign.

Demystifying Debt Financing Loans and Lines of Credit

Debt financing allows you to borrow money from a bank or other lending institution. This option provides immediate access to capital but comes with repayment obligations and interest charges. Carefully consider your future cash flow to ensure you can manage loan repayments. Loans are often best suited for established businesses with a proven track record. Lines of credit offer more flexibility, allowing you to access funds as needed.

Venture Capital Fueling High-Growth Startups

Venture capitalists (VCs) are firms that invest in high-growth companies with the potential for significant returns. Securing VC funding can be challenging, as VCs typically invest in established startups with a clear path to scalability. Be prepared to demonstrate a large market opportunity, a strong management team, and a well-defined exit strategy for investors.

Government Grants and Incentives Unveiling Public Funding

Government agencies often offer grants and incentives to support businesses in specific sectors or regions. Research available programs that align with your industry and business goals. Be prepared to submit detailed proposals outlining your company’s mission, impact potential, and how the grant will contribute to your growth.

Alternative Funding Options Exploring Innovative Approaches

Several non-traditional funding options are emerging for businesses. Revenue-based financing provides capital in exchange for a percentage of your future sales. Equipment leasing allows you to acquire necessary equipment without a large upfront investment. Explore these options if they align with your specific business needs.

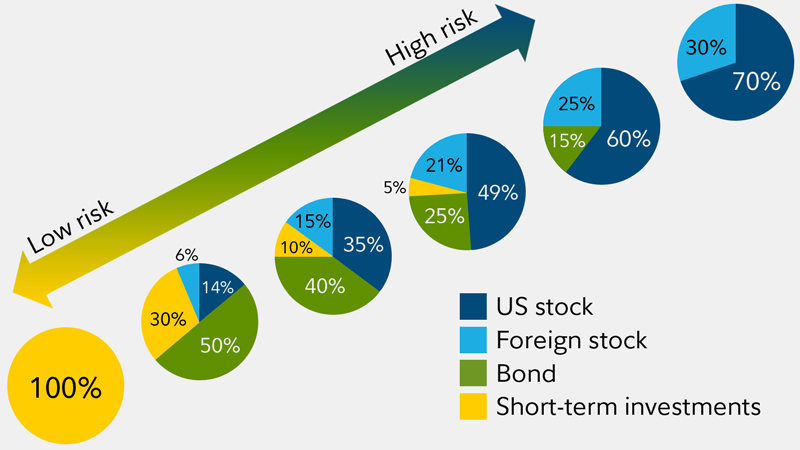

Choosing the Right Fit Matching Needs with Investment Sources

The ideal funding source depends on your specific needs and stage of development. For early-stage businesses, bootstrapping, friends & family, and crowdfunding may be suitable options. As your business grows, consider debt financing or angel investors. Businesses with high-growth potential can explore venture capital. Government grants and alternative financing options can be valuable throughout your entrepreneurial journey.

The Takeaway Building a Sustainable Financial Future

Financing your entrepreneurial dream requires careful planning and exploration. Understanding the various options empowers you to make informed decisions. Remember, funding is just one piece of the puzzle. Combine your chosen financial strategy with a solid business plan, a dedicated team, and a relentless drive to succeed, and you’ll be well on your way to transforming your vision into a thriving reality.

Beyond the Initial Funding Strategies for Continued Growth

Securing initial funding is a significant milestone, but the journey doesn’t end there. Here are additional strategies to ensure your financial sustainability:

- Mastering Financial Management: Develop a strong financial management system that tracks income, expenses, and cash flow. Regularly review your financials and adjust your strategies as needed.

- Building Strategic Partnerships: Partnering with complementary businesses can open new revenue streams and reduce costs. Explore opportunities for co-marketing, joint ventures, or strategic alliances.

- The Art of Negotiation: Hone your negotiation skills to secure the best possible terms for deals, leases, and contracts. Every dollar saved strengthens your financial footing.

- Embrace Metrics and Data-Driven Decisions: Track key performance indicators (KPIs) that measure your business health. Utilize data to understand customer behavior, optimize marketing efforts, and make informed decisions about resource allocation.

- Building a Strong Credit History: Establishing a good credit history for your business allows you access to better loan terms and financing options in the future.

Conclusion

The road to entrepreneurial success is paved with challenges and triumphs. Understanding your funding options and employing strategic financial management empowers you to navigate the journey with confidence. Choose your funding source wisely, build a solid financial foundation, and most importantly, never stop believing in your dreams. With dedication, perseverance, and the right financial tools, you can transform your vision into a thriving business and leave a lasting mark on the world.